Resilience and Growth: The Trajectory of Engineering R&D Firms

- Chesapeake Group

- Mar 14, 2024

- 2 min read

Overview:

Engineering Research & Development (ER&D) firms are specialized entities that focus on the innovation and development of new products, technologies, and services.

These firms play a pivotal role in driving the technological advancements that shape various industries, including automotive, aerospace, healthcare, and telecommunications.

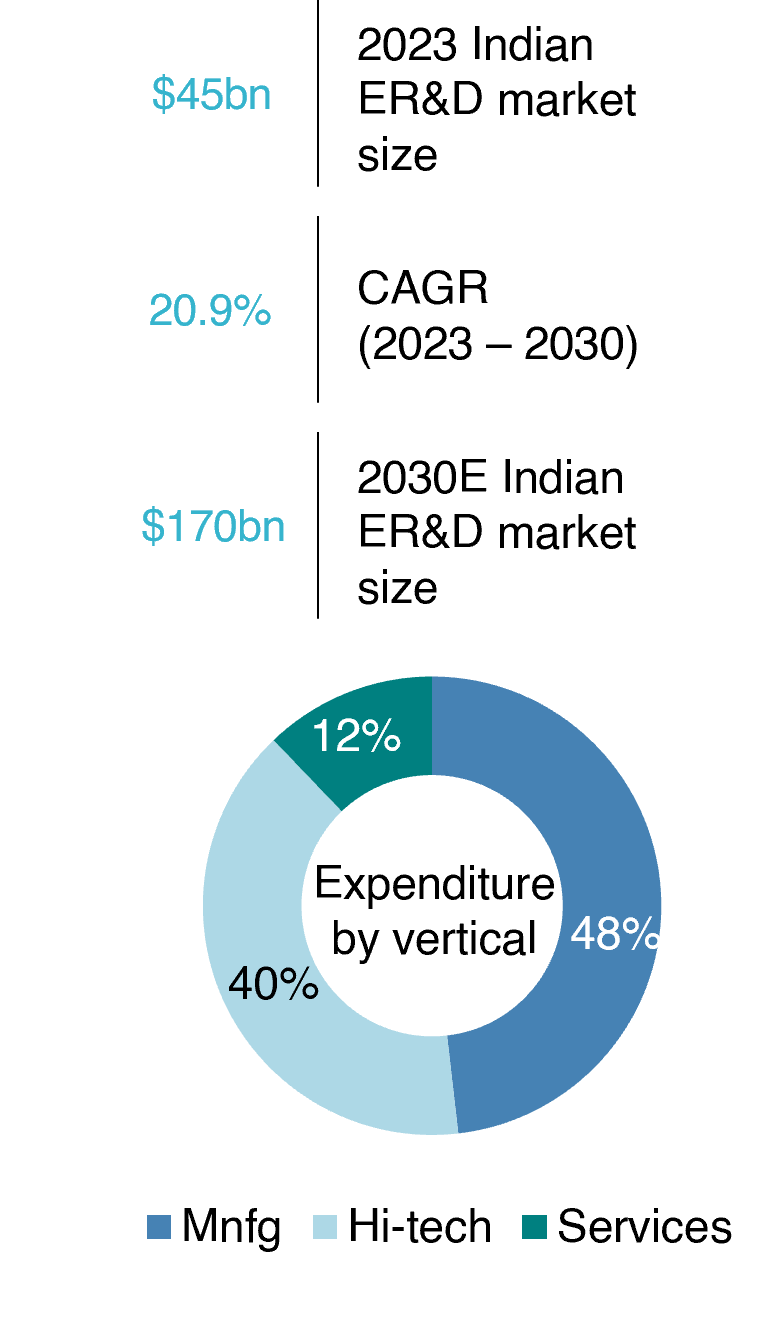

In India, the ER&D sector has seen significant growth and has become a hub for global companies seeking to leverage the country’s vast pool of engineering talent and cost-effective services.

Indian ER&D firms are not only supporting global enterprises but are also increasingly involved in end-to-end product development and innovation.

Creation of value through innovation:

A significant shift towards Digital Engineering (DE) is evident, with DE spending growing at a rate of 20% Y-o-Y. This reflects the industry’s evolving priorities, focusing on harnessing digital tools and technologies to streamline engineering processes.

ER&D services are in demand due to rising expenditures on the Internet of Things (IoT) and the need for customized products.

Indian ER&D Global Capability Centers (GCCs) are driving innovation across various sectors, particularly in the automotive industry with advancements in technologies like Advanced Driver Assistance Systems (ADAS) and infotainment systems. The demand for professionals skilled in data analytics, AI / ML, and cloud computing is rising, highlighting the need for a thriving IT ecosystem and a vast pool of highly skilled engineers to meet the demands and drive innovation.

Key considerations for setting up a GCCs in India includes talent availability to build scalable engineering teams, presence of a mature technology ecosystem, ease of doing business, and the ability to build teams at affordable costs. More than 85% of the top fifty ER&D firms have set up their GCCs in India.

Indian IT companies are increasingly focusing on ER&D services, recognizing the growing demand for high-end engineering and potential for innovation. This shift is driven by the need to re-engineer products to make them suitable for contemporary markets and to scale up to global standards. Mid-cap IT companies are benefitting from this rise in demand for ER&D.

There seems to a pick in ER&D acquisitions by Indian IT players. Infosys acquired InSemi, a semiconductor design and embedded services provider for $33mn. Xoriant, a ChrysCapital backed firm, bought MapleLabs, a specialized product engineering firm serving Fortune 500 clients in the hi-tech industry. HCLTech acquired ASAP Group, a German-based automotive engineering services provider for $279mn. Capgemini acquired HDL Design House, a provider of silicon design and verification services in Europe to boost its semiconductor capabilities.

Key players:

In India, the ER&D landscape is dominated by both global players that have set up GCCs and homegrown service providers. Indian IT giants such as TCS, Infosys, and Wipro have been expanding their ER&D services to cater to global demand.

The ER&D sector in India is also witnessing the rise of startups that are making a mark with innovative solutions and products. The government’s push towards digital transformation and the establishment of smart cities has further opened opportunities for these players.

Comments